Investing in real estate has long been a popular wealth-building strategy in Australia. With its stable economy, growing population, and strong demand for housing, the Australian property market offers attractive opportunities for investors. One of the key metrics used to evaluate the performance of an investment property is rental yield. Whether you’re a seasoned investor or a first-time buyer, understanding rental yields is crucial to making informed decisions. In this blog post, we’ll explore what rental yields are, how they’re calculated, and what factors influence them in the Australian property market.

What is Rental Yield?

Rental yield is a measure of the income generated by an investment property relative to its value. It’s expressed as a percentage and helps investors assess the profitability of a property. There are two types of rental yields:

- Gross Rental Yield: This is the annual rental income as a percentage of the property’s purchase price or market value. It doesn’t account for expenses like maintenance, property management fees, or taxes.

- Net Rental Yield: This is the annual rental income minus all associated expenses, expressed as a percentage of the property’s value. It provides a more accurate picture of the property’s profitability.

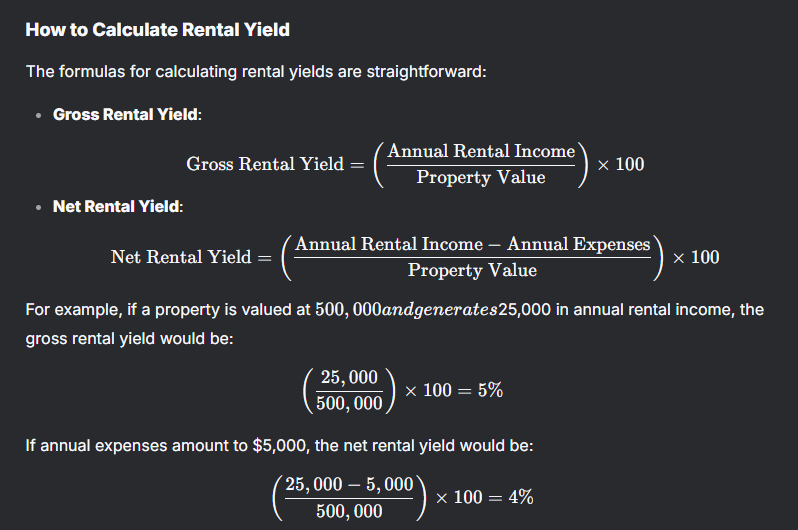

How to Calculate Rental Yield

The formulas for calculating rental yields are straightforward:

Rental Yields Across Australia

Rental yields vary significantly across Australia, depending on factors like location, property type, and market conditions. Here’s a snapshot of rental yields in major cities and regions as of recent data:

- Sydney:

- Gross Rental Yield: ~2.5% to 3.5%

- Sydney’s property market is known for its high property prices, which often result in lower rental yields. However, strong capital growth potential can offset this.

- Melbourne:

- Gross Rental Yield: ~2.8% to 3.8%

- Similar to Sydney, Melbourne’s high property prices lead to modest rental yields, but the city’s desirability and population growth make it a popular investment destination.

- Brisbane:

- Gross Rental Yield: ~4% to 5%

- Brisbane offers more affordable property prices compared to Sydney and Melbourne, resulting in higher rental yields. The city’s growing population and infrastructure development also make it attractive.

- Perth:

- Gross Rental Yield: ~4.5% to 5.5%

- Perth’s property market has seen a resurgence in recent years, with increasing demand for rentals driving up yields.

- Adelaide:

- Gross Rental Yield: ~4% to 5%

- Adelaide’s affordability and steady rental demand make it a solid choice for investors seeking consistent yields.

- Regional Areas:

- Gross Rental Yield: ~5% to 7%

- Regional areas often offer higher rental yields due to lower property prices and strong demand for housing, particularly in areas with mining, agriculture, or tourism industries.

Factors Influencing Rental Yields

Several factors can impact rental yields in the Australian property market:

- Location:

Location is one of the most significant determinants of rental yield. Properties in high-demand areas, such as capital cities or regions with strong employment opportunities, tend to have higher rental incomes. However, property prices in these areas are also higher, which can reduce yields. - Property Type:

The type of property can influence rental yield. For example, apartments often have higher yields than houses because they are more affordable to purchase and maintain. On the other hand, houses may offer better capital growth potential. - Market Conditions:

Supply and demand dynamics play a crucial role in rental yields. In a tight rental market with low vacancy rates, landlords can charge higher rents, boosting yields. Conversely, an oversupply of properties can lead to lower rents and reduced yields. - Economic Factors:

Economic conditions, such as interest rates, employment levels, and wage growth, can impact rental yields. For instance, low interest rates can make borrowing cheaper, increasing demand for property and driving up prices, which may lower yields. - Property Condition:

Well-maintained properties in good locations are more likely to attract tenants and command higher rents, improving rental yields. - Government Policies:

Government policies, such as tax incentives, rental regulations, and infrastructure investments, can influence rental yields. For example, changes to negative gearing or capital gains tax can affect investor behavior.

The Trade-Off Between Yield and Capital Growth

When investing in property, it’s essential to consider the balance between rental yield and capital growth. High-yield properties, such as those in regional areas, may generate strong rental income but have slower capital growth. Conversely, properties in capital cities may offer lower yields but significant long-term appreciation in value.

Investors should align their strategy with their financial goals. For example, retirees may prioritize high-yield properties for steady income, while younger investors may focus on capital growth to build wealth over time.

Tips for Maximizing Rental Yields

- Choose the Right Location:

Research areas with strong rental demand, low vacancy rates, and growth potential. - Invest in Up-and-Coming Areas:

Look for suburbs or regions undergoing development or infrastructure improvements, as these can drive rental demand and property values. - Optimize Property Management:

A good property manager can help maximize rental income, minimize vacancies, and reduce maintenance costs. - Add Value to the Property:

Renovations or upgrades, such as modern kitchens or energy-efficient features, can increase rental income and attract quality tenants. - Monitor Market Trends:

Stay informed about market conditions, rental trends, and economic factors that could impact yields.

The Future of Rental Yields in Australia

The Australian property market is constantly evolving, and rental yields are influenced by a range of factors, including population growth, housing supply, and economic conditions. In recent years, the COVID-19 pandemic has reshaped the rental market, with increased demand for regional properties and a shift in tenant preferences.

Looking ahead, rental yields are likely to remain strong in areas with limited housing supply and growing populations. However, investors should be mindful of potential challenges, such as rising interest rates, changing government policies, and economic uncertainty.

Conclusion

Rental yield is a critical metric for evaluating the performance of an investment property in Australia. While high yields can provide attractive income, it’s essential to consider other factors, such as capital growth potential, location, and market conditions. By understanding rental yields and conducting thorough research, investors can make informed decisions and maximize their returns in the dynamic Australian property market.

Whether you’re investing in a bustling city or a tranquil regional town, rental yields offer valuable insights into the profitability of your property. As with any investment, careful planning, due diligence, and a long-term perspective are key to success.

Disclaimer: This blog post is for informational purposes only and does not constitute financial or investment advice. Always consult with a qualified professional before making investment decisions.